It looks as if Whistleblow Wall Street, the campaign about which I wrote last week and am involved with, is getting off the ground in a big way. Several newspapers and media outlets are reporting on the campaign, some more favorably than others. This Sunday’s New York Post, headlined its business section feature article,“Billboards urge… [Read More]

Whistleblow Wall Street – A Call to Action!

I’m a firm believer that, eventually, if there is enough of a public outcry, we can make a difference and impact the path this country and our government is taking. For some time, I have been calling for greater accountability from the large Wall Street banks and have openly questioned why the Department of Justice… [Read More]

A Test Case for the DOJ’s New Policy?

In my last post: New DOJ Policy to Prosecute…Real or Smokescreen?, I commented that the DOJ’s new policy to go after individuals who commit financial crimes — not just settle for fines, was a step in the right direction. I also expressed some cynicism, given their track record so far. While it’s my belief that… [Read More]

New DOJ Policy to Prosecute … Real or Smokescreen?

Perhaps, finally the hue and cry to prosecute those responsible for the 2008 financial crisis is having an impact. It looks as if the Department of Justice is changing its tune. This last Wednesday, the DOJ announced a new policy to go after the individuals who have committed financial crimes. Deputy Attorney General Sally Yates… [Read More]

All This Misbehavior, and No One Is Guilty!

In last week’s post, I shared the op-ed that I co-authored with Allen West, President and CEO of the National Center for Policy Analysis (NCPA), We Must Learn From the 2008 Crash or Repeat It …Soon. In the op-ed we pointed out that several recent indicators were somewhat alarming: the recent stock market roller coaster,… [Read More]

How Bankers Avoid the Slammer

In a recent Atlantic article, “How Wall Street’s Bankers Stayed Out of Jail,” William D. Cohan asks, “the probes into bank fraud, leading to the financial industry’s crash have been quietly closed. Is this justice?” It appears that the legal window for punishing Wall Street bankers for fraudulent actions that contributed to the 2008 crash has… [Read More]

Bamboozling by Banks and Regulators Reaches An All Time High!

It seems our banking regulators and agencies are becoming even more creative in order to get around having to impose the normal penalties against large banks for fraudulent behavior. A recent case in point is HUD‘s proposing to modify their individual loan certification form which is currently required by banks to obtain FHA insurance. With… [Read More]

Broken Windows, Broken Banks! It’s time to institute a Wall Street “Zero Tolerance” policy.

In 1995, New York City Mayor Rudy Giuliani, launched a “zero tolerance” policy. NYC had long been out of control, rife with crime. Giuliani knew strong measures were a must if the city were to survive. “Zero tolerance” was first talked about by James Q. Wilson and George Kelling in a 1982 Atlantic Monthly article…. [Read More]

Customers Can Hold Banks Accountable! Santa Cruz says NO! to TBTF Banks

A recent Nation of Change op-ed piece featured Robert Reich (political economist, professor, author, and political commentator. Reich also served in Presidents Gerald Ford and Jimmy Carter’s administrations and was Secretary of Labor under President Bill Clinton from 1993 to 1997). After asking, “What exactly does it mean for a big bank to plead guilty to… [Read More]

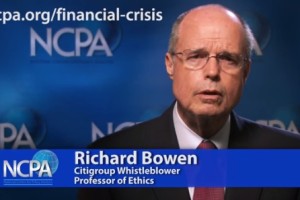

What Caused the 2008 Financial Crisis? Interview by NCPA

The National Center for Policy Analysis Financial Crisis Initiative has honored Richard by inviting him to be part of their task force investigating the events which led up to the 2008 financial debacle. The NCPA interviews with Richard are included below. Richard comments, “I’m deeply honored and humbled to be part of this initiative. NCPA… [Read More]

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- Next Page »