In the last couple of weeks, I’ve been featured/quoted in several publications, Wall Street on Parade, the NY Times Dealbook and the New York Post, as have several other whistleblowers, Eric Ben-Artzi, Alayne Fleishmann and Gary Aguirre, among others. In sifting through these articles and others, I am seeing a pattern develop which deeply troubles me… [Read More]

Wells Fargo, Fried Again!

Well, it looks as if Wells Fargo, the self-proclaimed “community-based financial services company” is once again on the hot seat.The bank had been forcing unneeded collision insurance on customers who financed their car purchases through the bank. That practice, first disclosed by The New York Times, affected 800,000 customers according to an analysis commissioned by the bank. The bank… [Read More]

It’s the Payouts, Stupid!

Well, that’s not quite what Federal Deposit Insurance Corporation‘s (FDIC) Vice Chair Thomas Hoenig said; however, there was no question about his position. A recent Reuter’s article, “Payouts, not capital requirements, are to blame for fewer bank loans: FDIC Chairman,” explains that Hoenig, in a recent letter, cautioned Senate Banking Committee Chairman Mike Crapo (R… [Read More]

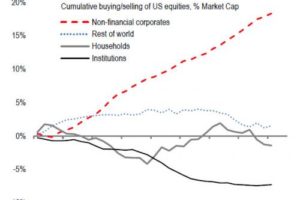

Don’t Pop Open the Bubbly Just Yet! This Market Buying Activity Used to be illegal.

The stock market is up and we should all be celebrating. However before you pop open the champagne, let’s look at the real story. The stock buybacks driving the market used to be illegal because they manipulated the market. The stock market has been on a tear since 2009, rising to record levels, and optimism… [Read More]

If You Check the Box …You’ve Given Away Your Rights! But CFPB is Coming to the Rescue!

Every day, we sign up for programs, install smart phone apps, shop online and check the box that says we’ve read and agreed to the merchant’s terms. Yet, have you read them? And if you don’t check the box, you can’t “buy” the product so what choice is there? In that fine print though you… [Read More]

Are Clawbacks and Shareholder Proposals Essential to Corporate Governance?

The recent Wells Fargo financial misdoings situation has focused much-needed attention once again on clawbacks, the forced return of pay and stock grants, and shareholders involvement in corporate guidance policies. The Wells Fargo’s board voted to claw back an additional $75 million in compensation from the bank’s former chief executive, John G. Stumpf, and its former head of community… [Read More]

FED UP… An Insider’s Take On Why The Federal Reserve Is Bad For America

Danielle DiMartino Booth’s book FED Up is an insider’s take on why our Federal Reserve System is deeply flawed and requires major change. It is an interesting and disturbing read into the working of the Fed by one who’s been there and understands the system. I was deeply disturbed by some of her observations, most especially on… [Read More]

Culture Is the Way We Do Things Here

“Culture is in fact the basis of an organization and it absolutely influences people’s day to day behavior,” comments Veronica Melian in an article originally published in Deloitte’s “Directors’ Alert 2017: Courage Under Fire: Embracing Disruption.” She says, “Organizations have traditionally devoted considerable time and effort to developing sophisticated strategies to capitalize on market opportunities and mitigate market… [Read More]

The White House Flouts Ethics Rules

“The White House just used a brazen back door move to bypass the Senate”… read the headlines of a recent Vanity Fair article regarding the appointment of Keith A. Noreika as the Acting Comptroller of the Currency, which makes Mr. Norieka the administrator of the federal banking system and acting head of the Office of the Comptroller of… [Read More]

The Ethics Merry Go Round

The McCuistion program, which airs in Dallas/Fort Worth on PBS station KERA, recently re-aired its program, Ethics and Transparency as Antidotes to Financial Fraud. Host Dennis McCuistion asked the guests what ethics and the lack of transparency may have done to contribute to the 2008 financial crisis? One of his guests, Marianne Jennings, J.D.: Professor… [Read More]

- « Previous Page

- 1

- …

- 8

- 9

- 10

- 11

- 12

- Next Page »