The elephant in the room is still why there have been no criminal prosecutions of the banks, executives and Wall Street traders who were primarily responsible for the 2008 financial crisis. There has been no obvious answer, although our Department of Justice continues to dance around the question. In his most recent article, my friend… [Read More]

Philosophy for Bankers…? How About Just Classes in Honesty and Ethics?

Several articles came across my desk this week. I found one especially intriguing, as it fits my frame of reference. It is a post by Ms. Yves Smith, commenting on an article “Can Philosophy Stop Bankers From Stealing?” by Lynn Parramore, a senior research analyst at the Institute for New Economic Thinking. Smith argues that the title might… [Read More]

Chicken Little was right – “the sky IS falling”!

Remember Chicken Little and her warning, the sky is falling? I sometimes feel like a Chicken Little, with my repeated warnings that the sky is indeed falling and here’s another example. Just last week I posted about my fellow Bank Whistlebowers United colleague Michael Winston’s interview with Gretchen Morgenson on the New York Times Facebook venue. I’m still… [Read More]

Michael Winston, “Wall Street’s Greatest Enemy,” tells all

Whistleblowers come in all shapes and sizes and my friend and fellow Bank Whistleblowers United colleague is certainly not one that fits most descriptions of a whistleblower. I’d mentioned Michael before in two fairly recent posts (see here and here). Former Countrywide Financial executive Michael G. Winston, PhD, was at the pinnacle of establishment success. He’d… [Read More]

“Take On Wall Street” – a Bold Agenda to Control the Large Banks!

A new group, Take On Wall Street, has emerged which vows it won’t rest until it breaks up the big banks and stops the stranglehold Wall Street has on Congress and the American taxpayer! Take On Wall Street may have enough backing behind it do so. Twenty national organizations joined Senator Elizabeth Warren (D- Mass)… [Read More]

The 2nd NCPA Financial Crisis Initiative kicks off with the Honorable Jeb Hensarling (R-TX)

This week the National Center for Policy Analysis (NCPA) is holding its second Financial Crisis Initiative conference in Washington, D.C. I’ll be part of the panel discussions along with my colleague Marianne Jennings, ethicist and the author of The Seven Signs of Ethical Collapse and several other speakers who were in Dallas this month. The D.C. audience… [Read More]

The DOJ Lemon Award – Go Directly to Jail!

William K. Black, a professor of Economics and Law, UMKC, a former financial regulator and author of The Best Way to Rob a Bank is To Own One, and one of our Bank Whistleblowers United (BWU) co-founders has decided we could “retire” our series of BWU Lemon Awards and permanently award “a Lemon” award to… [Read More]

Silence is Deadly. Lessons Learned.

The audience was primarily internal auditors at my presentation this week at the 11th Annual Fraud Summit, held at the University of Texas at Dallas, where I teach, sponsored by the Institute of Internal Auditors, the Association of Certified Fraud Examiners, and Information Systems Audit and Control Association. I talked about fraud and how as… [Read More]

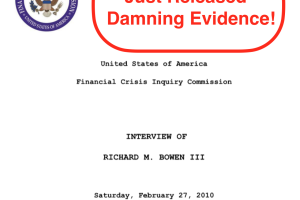

Now We Know — The DOJ Ignored Two FCIC Citi Criminal Referrals!

Several items have recently hit the press regarding the financial crisis of 2008 which could lead to further investigation of what actually happened and who is responsible. One that has me excited is the National Archives releasing the first of many documents of the Financial Crisis Inquiry Commission (FCIC) which have been sealed for five… [Read More]

Is Fraud in the Eye of the Beholder? Andy Fastow Explains

I spoke recently to a Dallas Society of CPAS conference focusing on fraud, speaking on ethics and fraud and the financial crisis. However, the speaker after me addressed the audience on Rules vs. Principles, and his presentation is worthy of some discussion. He started his presentation by holding up two items, in his right hand a trophy… [Read More]