As my friend William D. Cohan said in a recent New York Times post, “nearly eight years after the onset of the financial crisis; its unintended consequences continue to startle and amaze.” The latest in a long saga of TBTF bank settlements, Goldman Sachs, one of the more recent banks to resolve settlements charges for the… [Read More]

We Need To Speak Up, Loud and Clear!

Over 450 educators were in my audience this last weekend when I addressed the members of the American Accounting Association Auditors Section, the largest community of accountants and auditors in academia, So what happened, I asked them? In the financial crisis, how was it possible that all of the large financial institutions that either failed or were bailed out… [Read More]

Is the Government Nationalizing U.S. Companies?

Since 2012, the U.S. seems to be business as usual. Stocks have been climbing, the “too big to fail” banks have basically paid back their government “bail out” money. The housing market has boomed, with too few homes to go around, causing much higher demand for rentals. Unfortunately, this has resulted in some renters having… [Read More]

What Were the Major Causes of the 2008 Financial Crisis?

The National Center for Policy Analysis (NCPA) Financial Crisis Initiative is accumulating talent from scholars and practitioners nationwide to research and come to consensus on two central questions of 2008: What were the major causes of the financial crisis? What policies can and should be implemented to prevent a reoccurrence? To answer these questions, the NCPA… [Read More]

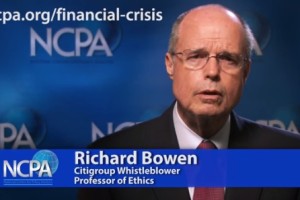

What Caused the 2008 Financial Crisis? Interview by NCPA

The National Center for Policy Analysis Financial Crisis Initiative has honored Richard by inviting him to be part of their task force investigating the events which led up to the 2008 financial debacle. The NCPA interviews with Richard are included below. Richard comments, “I’m deeply honored and humbled to be part of this initiative. NCPA… [Read More]

What Would You Do?

The room filled with almost 300 bankers plus was very quiet. The 60 Minute interview with Steve Kroft, which told about what I had experienced at Citi, had just finished playing. There was a collective sigh when the clip stopped and I asked, “What would you do?,” if you had experienced widespread fraud, corruption and… [Read More]

Were Bank Settlements Really Payments of Extortion to the Department of Justice??

Congratulations are in order to the Federal Housing Finance Agency, which has managed to bring a case to trial against Nomura Holdings and the Royal Bank of Scotland, two foreign banks with little U.S. reputational risk. This relatively obscure agency oversees Fannie Mae and Freddie Mac. Considering they have nowhere near the power of our federal regulators and prosecutors at our… [Read More]

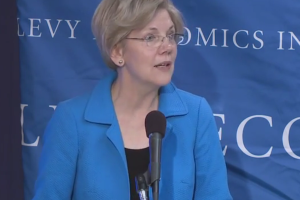

Unfinished Business and Financial Reforms with Elizabeth Warren

In a presentation Elizabeth Warren gave at the Levy Institute’s 24th annual Hyman P. Minsky Conference, she asked: what are we to make of Dodd-Frank five years later? She asked us to go back to the Wall Street crash of 1929 and how the government responded to it. In response to the crash, our policy… [Read More]

Too Big To Fail Survey

Too Big to Fail, a U.S. television drama film was first broadcast on HBO, May 23, 2011. Based on Andrew Ross Sorkin‘s non-fiction book Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System—and Themselves (2009), the film received public acclaim and 11 nominations at the 63rd… [Read More]

Why Is Our Government in the Mortgage Business?

We sure don’t want to be, but it looks like we are heading in that direction. “In the name of affordable loans, the White House is creating the conditions for a replay of the housing disaster,” states the caption in a recent WSJ article on the “coming mortgage meltdown.” [tweetthis twitter_handles=”@richardmbowen”]Why are we – oh,… [Read More]