The audience was primarily internal auditors at my presentation this week at the 11th Annual Fraud Summit, held at the University of Texas at Dallas, where I teach, sponsored by the Institute of Internal Auditors, the Association of Certified Fraud Examiners, and Information Systems Audit and Control Association. I talked about fraud and how as… [Read More]

Goldman Sachs aka The Great Vampire Squid Rides Again!

As my friend William D. Cohan said in a recent New York Times post, “nearly eight years after the onset of the financial crisis; its unintended consequences continue to startle and amaze.” The latest in a long saga of TBTF bank settlements, Goldman Sachs, one of the more recent banks to resolve settlements charges for the… [Read More]

We Need To Speak Up, Loud and Clear!

Over 450 educators were in my audience this last weekend when I addressed the members of the American Accounting Association Auditors Section, the largest community of accountants and auditors in academia, So what happened, I asked them? In the financial crisis, how was it possible that all of the large financial institutions that either failed or were bailed out… [Read More]

Is the Government Nationalizing U.S. Companies?

Since 2012, the U.S. seems to be business as usual. Stocks have been climbing, the “too big to fail” banks have basically paid back their government “bail out” money. The housing market has boomed, with too few homes to go around, causing much higher demand for rentals. Unfortunately, this has resulted in some renters having… [Read More]

How Bankers Avoid the Slammer

In a recent Atlantic article, “How Wall Street’s Bankers Stayed Out of Jail,” William D. Cohan asks, “the probes into bank fraud, leading to the financial industry’s crash have been quietly closed. Is this justice?” It appears that the legal window for punishing Wall Street bankers for fraudulent actions that contributed to the 2008 crash has… [Read More]

Bamboozling by Banks and Regulators Reaches An All Time High!

It seems our banking regulators and agencies are becoming even more creative in order to get around having to impose the normal penalties against large banks for fraudulent behavior. A recent case in point is HUD‘s proposing to modify their individual loan certification form which is currently required by banks to obtain FHA insurance. With… [Read More]

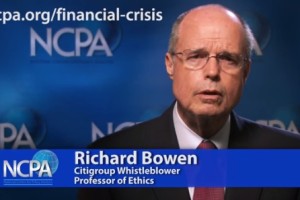

What Caused the 2008 Financial Crisis? Interview by NCPA

The National Center for Policy Analysis Financial Crisis Initiative has honored Richard by inviting him to be part of their task force investigating the events which led up to the 2008 financial debacle. The NCPA interviews with Richard are included below. Richard comments, “I’m deeply honored and humbled to be part of this initiative. NCPA… [Read More]

The D.O.J gets ready for the next round….lets see if the banks get away…again!

Looks as if the new U.S. Attorney General, Loretta Lynch, is taking over the so called pursuing of bank settlements along the same lines her predecessor Eric Holder did. Let’s hope that this time around the banks are held accountable and investors are finally compensated. The settlements relate to securities backed by residential mortgages that plunged… [Read More]

What Would You Do?

The room filled with almost 300 bankers plus was very quiet. The 60 Minute interview with Steve Kroft, which told about what I had experienced at Citi, had just finished playing. There was a collective sigh when the clip stopped and I asked, “What would you do?,” if you had experienced widespread fraud, corruption and… [Read More]

Why Is Our Government in the Mortgage Business?

We sure don’t want to be, but it looks like we are heading in that direction. “In the name of affordable loans, the White House is creating the conditions for a replay of the housing disaster,” states the caption in a recent WSJ article on the “coming mortgage meltdown.” [tweetthis twitter_handles=”@richardmbowen”]Why are we – oh,… [Read More]