Perhaps, finally the hue and cry to prosecute those responsible for the 2008 financial crisis is having an impact. It looks as if the Department of Justice is changing its tune. This last Wednesday, the DOJ announced a new policy to go after the individuals who have committed financial crimes. Deputy Attorney General Sally Yates… [Read More]

All This Misbehavior, and No One Is Guilty!

In last week’s post, I shared the op-ed that I co-authored with Allen West, President and CEO of the National Center for Policy Analysis (NCPA), We Must Learn From the 2008 Crash or Repeat It …Soon. In the op-ed we pointed out that several recent indicators were somewhat alarming: the recent stock market roller coaster,… [Read More]

How Bankers Avoid the Slammer

In a recent Atlantic article, “How Wall Street’s Bankers Stayed Out of Jail,” William D. Cohan asks, “the probes into bank fraud, leading to the financial industry’s crash have been quietly closed. Is this justice?” It appears that the legal window for punishing Wall Street bankers for fraudulent actions that contributed to the 2008 crash has… [Read More]

Don’t Stay Silent: Stand up and Raise Your Hand!

Last Sunday, I told my American Accounting Association audience (AAA) that I tell my accounting students that at some point in their careers they may be asked to do something, or not do something, that makes them very uncomfortable, that makes them feel that something is not quite right. If so, then they need to… [Read More]

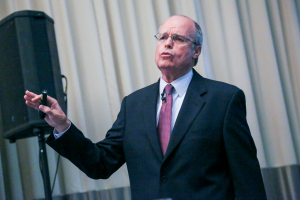

Behavioral Ethics: Too Big To Fail and the Financial Crisis

This coming week, I will be speaking at the annual conference of the American Accounting Association (AAA). AAA is the largest community of accountants in academia; key experts in that field on leading-edge research and publications. They are well known and respected as thought leaders and for shaping the future of accounting through teaching, research… [Read More]

Broken Windows, Broken Banks! It’s time to institute a Wall Street “Zero Tolerance” policy.

In 1995, New York City Mayor Rudy Giuliani, launched a “zero tolerance” policy. NYC had long been out of control, rife with crime. Giuliani knew strong measures were a must if the city were to survive. “Zero tolerance” was first talked about by James Q. Wilson and George Kelling in a 1982 Atlantic Monthly article…. [Read More]

Customers Can Hold Banks Accountable! Santa Cruz says NO! to TBTF Banks

A recent Nation of Change op-ed piece featured Robert Reich (political economist, professor, author, and political commentator. Reich also served in Presidents Gerald Ford and Jimmy Carter’s administrations and was Secretary of Labor under President Bill Clinton from 1993 to 1997). After asking, “What exactly does it mean for a big bank to plead guilty to… [Read More]

What Caused the 2008 Financial Crisis? Interview by NCPA

The National Center for Policy Analysis Financial Crisis Initiative has honored Richard by inviting him to be part of their task force investigating the events which led up to the 2008 financial debacle. The NCPA interviews with Richard are included below. Richard comments, “I’m deeply honored and humbled to be part of this initiative. NCPA… [Read More]

Toward Accountability… Maybe Just a Small Step

It’s just a small step, but it’s at least a step in the right direction. I’m heartened by a recent call to action by Rep. Maxine Waters, (D – CA), the ranking member on the House Financial Services Committee, in an article published in the American Bankers magazine. This last February, federal prosecutors began a… [Read More]

What Would You Do?

The room filled with almost 300 bankers plus was very quiet. The 60 Minute interview with Steve Kroft, which told about what I had experienced at Citi, had just finished playing. There was a collective sigh when the clip stopped and I asked, “What would you do?,” if you had experienced widespread fraud, corruption and… [Read More]