Will the new scrutiny House Financial Services Committee chairwoman Maxine Waters proposes prevent another financial crisis? Last week Ms. Waters pledged that this committee will keep an eye on the larger banks and pay closer attention to whether regulators were trying to weaken the safeguards and regulations enacted after the last financial crisis. What some… [Read More]

The DOJ Lemon Award – Go Directly to Jail!

William K. Black, a professor of Economics and Law, UMKC, a former financial regulator and author of The Best Way to Rob a Bank is To Own One, and one of our Bank Whistleblowers United (BWU) co-founders has decided we could “retire” our series of BWU Lemon Awards and permanently award “a Lemon” award to… [Read More]

A Test Case for the DOJ’s New Policy?

In my last post: New DOJ Policy to Prosecute…Real or Smokescreen?, I commented that the DOJ’s new policy to go after individuals who commit financial crimes — not just settle for fines, was a step in the right direction. I also expressed some cynicism, given their track record so far. While it’s my belief that… [Read More]

New DOJ Policy to Prosecute … Real or Smokescreen?

Perhaps, finally the hue and cry to prosecute those responsible for the 2008 financial crisis is having an impact. It looks as if the Department of Justice is changing its tune. This last Wednesday, the DOJ announced a new policy to go after the individuals who have committed financial crimes. Deputy Attorney General Sally Yates… [Read More]

The D.O.J gets ready for the next round….lets see if the banks get away…again!

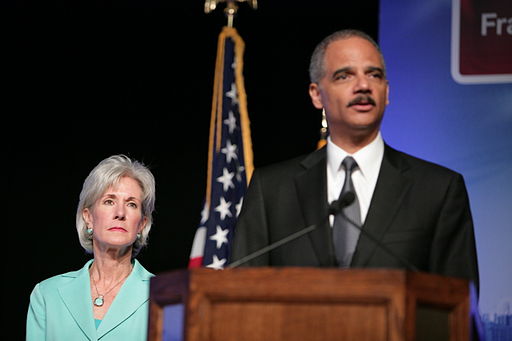

Looks as if the new U.S. Attorney General, Loretta Lynch, is taking over the so called pursuing of bank settlements along the same lines her predecessor Eric Holder did. Let’s hope that this time around the banks are held accountable and investors are finally compensated. The settlements relate to securities backed by residential mortgages that plunged… [Read More]

If you ain’t cheating…

“If you ain’t cheating, you ain’t trying,”’ says a Barclay Bank trader! This last week a consortium of the six biggest national and international banks were fined $5.6 billion for manipulating global currency and interest rates, going back to 2007. The six banks were Bank of America, Barclays, Citigroup, JP Morgan Chase, Royal Bank of Scotland and UBS. All… [Read More]

Were Bank Settlements Really Payments of Extortion to the Department of Justice??

Congratulations are in order to the Federal Housing Finance Agency, which has managed to bring a case to trial against Nomura Holdings and the Royal Bank of Scotland, two foreign banks with little U.S. reputational risk. This relatively obscure agency oversees Fannie Mae and Freddie Mac. Considering they have nowhere near the power of our federal regulators and prosecutors at our… [Read More]

Whistleblowing Has a Price – Is It Worth It?

Being a whistle-blower is not what an individual strives to be. It comes with strings attached, yet the “errors” some employers make leaves no room for silence. Alayne Fleischmann, recently of JP Morgan Chase, is another example of employee observation of their company’s wrongdoing – and the need to report what is egregious wrong doing…. [Read More]

Department of Justice – Encouraging Whistle Blowing or Blowing Smoke?

In a recent presentation at NYU’s law school, the former Attorney General Eric Holder, said the Department of Justice needs help from whistleblowers if they are to bring financial malfeasance to justice. As Holder stated, ” their evidence is crucial to the work of investigators.” Yet some of us question the motives and believe it’s… [Read More]