Whistleblowers come in all shapes and sizes and my friend and fellow Bank Whistleblowers United colleague is certainly not one that fits most descriptions of a whistleblower. I’d mentioned Michael before in two fairly recent posts (see here and here). Former Countrywide Financial executive Michael G. Winston, PhD, was at the pinnacle of establishment success. He’d… [Read More]

“Take On Wall Street” – a Bold Agenda to Control the Large Banks!

A new group, Take On Wall Street, has emerged which vows it won’t rest until it breaks up the big banks and stops the stranglehold Wall Street has on Congress and the American taxpayer! Take On Wall Street may have enough backing behind it do so. Twenty national organizations joined Senator Elizabeth Warren (D- Mass)… [Read More]

The 2nd NCPA Financial Crisis Initiative kicks off with the Honorable Jeb Hensarling (R-TX)

This week the National Center for Policy Analysis (NCPA) is holding its second Financial Crisis Initiative conference in Washington, D.C. I’ll be part of the panel discussions along with my colleague Marianne Jennings, ethicist and the author of The Seven Signs of Ethical Collapse and several other speakers who were in Dallas this month. The D.C. audience… [Read More]

The DOJ Lemon Award – Go Directly to Jail!

William K. Black, a professor of Economics and Law, UMKC, a former financial regulator and author of The Best Way to Rob a Bank is To Own One, and one of our Bank Whistleblowers United (BWU) co-founders has decided we could “retire” our series of BWU Lemon Awards and permanently award “a Lemon” award to… [Read More]

Silence is Deadly. Lessons Learned.

The audience was primarily internal auditors at my presentation this week at the 11th Annual Fraud Summit, held at the University of Texas at Dallas, where I teach, sponsored by the Institute of Internal Auditors, the Association of Certified Fraud Examiners, and Information Systems Audit and Control Association. I talked about fraud and how as… [Read More]

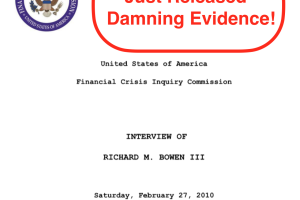

Now We Know — The DOJ Ignored Two FCIC Citi Criminal Referrals!

Several items have recently hit the press regarding the financial crisis of 2008 which could lead to further investigation of what actually happened and who is responsible. One that has me excited is the National Archives releasing the first of many documents of the Financial Crisis Inquiry Commission (FCIC) which have been sealed for five… [Read More]

Is Fraud in the Eye of the Beholder? Andy Fastow Explains

I spoke recently to a Dallas Society of CPAS conference focusing on fraud, speaking on ethics and fraud and the financial crisis. However, the speaker after me addressed the audience on Rules vs. Principles, and his presentation is worthy of some discussion. He started his presentation by holding up two items, in his right hand a trophy… [Read More]

Damn the Evidence! No Prosecutions for Citi

On several occasions, my colleagues and I have stated that the payment of the large bank settlements that were the outcome of the 2008 financial crisis were merely payments of extortion to the Department of Justice. The motive we believe was to lock up the evidence they had discovered so Americans and the world would… [Read More]

Bank Whistleblowers United D.C. Press Conference Hits a Home Run!

In spite of the stormy weather in D.C. last week Thursday, our Bank Whistleblowers United press conference got off to a rousing start. William Black and I were able to make it to D.C.; Michael Winston, stranded en route, called in on his cell, and Gary Aguirre joined us by Skype. Hosted by Campaign for… [Read More]

New Fed President Kashkari…Gone Rogue on Goldman or Smokescreen?

Interesting times we live in. And we need to ask whether the recent unprecedented comments by Neel Kashkari, the newly appointed President of the Minneapolis Federal Reserve, to break up the big banks is genuine or too good to be true and a political smokescreen. Former Goldman Sacks vice president Kashkari is a Republican and a… [Read More]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- 8

- Next Page »