The Securities and Exchange Commission (SEC) has recently announced it is discontinuing their enforcement program requiring admissions of wrongdoing and the prosecutorial approach they were supposedly taking after the 2008 financial crisis. Steven Peikin, co-director of the SEC’s enforcement division, said the SEC would drop the “broken windows” strategy of pursuing many cases over even… [Read More]

Busting the Financial Regulations Myth! Anat Admati’s Take

The caption of the photo of a founding father facing the New York Stock Exchange caught and held me. It stated, “It takes a willful blindness to liken financial crises to natural disasters.” I was hooked. Wall Street, our government and politicians have repeatedly, willfully and wrongfully branded the 2008 financial crisis a natural disaster,… [Read More]

Do We Have Government by Goldman?

As a headline of an article by The Intercept suggests? A funny thing happened on the road to the White House. A President who had railed against Goldman Sachs and other TBTF and proclaimed, “For too long, a small group in our nation’s capital has reaped the rewards of government while the people have borne… [Read More]

What an Honor to Present to SEACEN in Kuala Lumpur!

I recently spoke in Kuala Lumpur, Malaysia at a high-level conference on financial stability and supervision attended by top executives from the central banks of nineteen countries. The conference was sponsored by The South East Asian Central Banks (SEACEN) Research and Training Centre, based in Kuala Lumpur. SEACEN was established as a legal entity in… [Read More]

Wells Fargo: The Poster Child of Greed & Fraud

Wells Fargo has now become a never ending story of greed and fraud as the charges against them continue and even more charges come to light. It now looks as if they have uncovered an additional 1.4 million fake bank and credit card accounts for a total of up to 3.5 million accounts from their… [Read More]

Bankers Haven’t Gone to Jail Because They Are Innocent…Of Crimes?!

Astounding! Or so states the editorial board of the Wall Street Journal. Author and journalist William D. Cohan notes in a recent article that the WSJ op-ed asserted that bankers and traders didn’t go to jail for their bad behavior in the years leading up to the financial crisis “because they haven’t committed any crimes.” Mr. Cohan,… [Read More]

Wells Fargo, Fried Again!

Well, it looks as if Wells Fargo, the self-proclaimed “community-based financial services company” is once again on the hot seat.The bank had been forcing unneeded collision insurance on customers who financed their car purchases through the bank. That practice, first disclosed by The New York Times, affected 800,000 customers according to an analysis commissioned by the bank. The bank… [Read More]

It’s the Payouts, Stupid!

Well, that’s not quite what Federal Deposit Insurance Corporation‘s (FDIC) Vice Chair Thomas Hoenig said; however, there was no question about his position. A recent Reuter’s article, “Payouts, not capital requirements, are to blame for fewer bank loans: FDIC Chairman,” explains that Hoenig, in a recent letter, cautioned Senate Banking Committee Chairman Mike Crapo (R… [Read More]

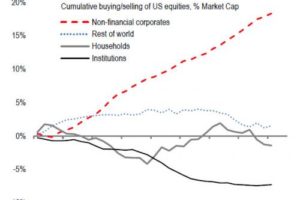

Don’t Pop Open the Bubbly Just Yet! This Market Buying Activity Used to be illegal.

The stock market is up and we should all be celebrating. However before you pop open the champagne, let’s look at the real story. The stock buybacks driving the market used to be illegal because they manipulated the market. The stock market has been on a tear since 2009, rising to record levels, and optimism… [Read More]

If You Check the Box …You’ve Given Away Your Rights! But CFPB is Coming to the Rescue!

Every day, we sign up for programs, install smart phone apps, shop online and check the box that says we’ve read and agreed to the merchant’s terms. Yet, have you read them? And if you don’t check the box, you can’t “buy” the product so what choice is there? In that fine print though you… [Read More]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 8

- Next Page »