The 2008 financial crisis, the worst in our history and the egregious fraud, greed and corruption which led to it, impacted not just the banking world but businesses and individuals worldwide. And, it could well have easily been prevented if best business practices had been followed. For the last two years, my team and I… [Read More]

They’re Back! Fannie and Freddie Ride Again

It looks as if Fannie Mae and Freddie Mac have not learned from their previous enabling of banks leading to the financial crisis. In fact, it looks as if the two are still using the same business model; they are lowering even further their underwriting standards to allow loans to be underwritten, ignoring student, credit… [Read More]

Is the Fed Really Interested In Protecting Consumers or Is It just Lip Service?

Eric Ben Artzi … is a former risk officer at Deutsche Bank. Mr. Ben-Artzi was one of three former Deutsche Bank employees turned whistleblowers who in 2010-2011 notified regulators of improper accounting at Deutsche. What was discovered resulted in a five-year investigation and a $55 million settlement between Deutsche Bank and the SEC. While Mr. Ben-Artzi was… [Read More]

Barclays Bank Gets Its Hands Slapped… and What Does That Change!!!??

Is getting its hands slapped a strong enough message? The latest in the bad bank sagas has the British bank, Barclays, red-faced. As it should. CEO Jes Staley has been reprimanded for attempting to discover the identity of an internal company whistleblower. Mr. Staley stated that he was trying to protect a colleague from what… [Read More]

The Saga of Wells Fargo – Are Banks Reaping What They Sow?

Wells Fargo is once again making national headlines for its less-than-ethical business practices. Recent headlines bowled me over: Wells Fargo being forced to reinstate employees – whistleblowers – who reported the ethics issues to their superiors, and pay their back pay! Their Board of Directors report decision laying the responsibility of the 2 million plus unauthorized bank and… [Read More]

Virtual Shareholder Meetings: Are They an Erosion of Transparency?

Technology has infiltrated every area of our lives in many positive ways making it easier to communicate and inform a wide range of people in many different ways. Some uses, however, may not have as positive an impact. One communication mode which is rapidly gaining followers is the use of “virtual” annual shareholder meetings which… [Read More]

Will the Real Preet Bharara Please Stand Up

Preet Bharara was one of 46 United States Attorneys appointed by President Barack Obama who was asked by the new administration to immediately resign. However, the request came as huge surprise to Mr. Bharara as it came just three months after he met with then president-elect Donald J. Trump, who had asked him to stay… [Read More]

Will Wall Street Soon Be Asking: Where’s Our ROI?

There is no free lunch. Eventually, the chips are called in and someone has to pay. For too long, in the “triangulation war” of citizen versus Wall Street and the government, it’s been the American taxpayer who loses. Now the debt has increased even further. According to a recent report by Americans for Financial Reform… [Read More]

The Freedom of Information Act – a Way to Keep Government Honest…and Our Democracy Safe

The Freedom of Information Act, or FOIA as it is commonly known, became the law of the land in 1966 in order to make it easier for the American people to get access to documents, notes and other relevant information about how the federal government wields its considerable power. It is a critical element to… [Read More]

Should We Welcome Back Wall Street?

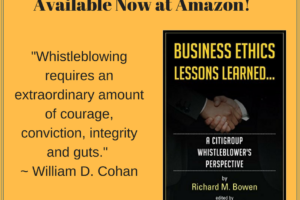

A recent New York Times Sunday Review featured an article by my friend, William D. Cohan, author of The House of Cards and the forthcoming Why Wall Street Matters. The article, Welcome Back Wall Street, points out President Trump’s vilifying Wall Street throughout his campaign and his present about face- which is now welcoming Wall Street’s… [Read More]