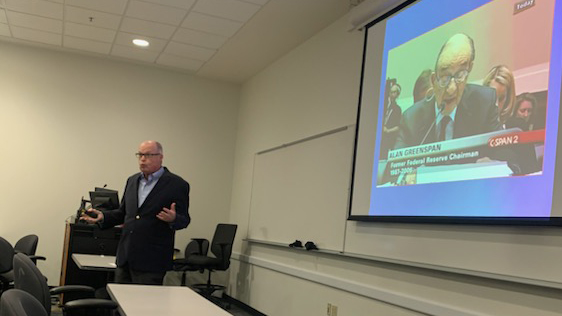

On Wednesday, March 8, I gave a talk on corporate ethics to the Corporate Governance business graduate course at the University of Texas at Dallas, taught by professor Greg Ballew. I noted to the class that, despite substantial evidence of wrongdoing, no banking industry executives were prosecuted in the last financial crisis. Because of this, I believe that the only lesson the banks learned is that no entity will hold them or their high-ranking officials accountable for future wrongdoing.

In the Q&A session at the conclusion of my talk, a student asked me about the possibility of another financial crisis, and I told the class that there was no doubt in my mind that our country would be going into another financial crisis, although I could not predict the timing or circumstances involved.

Little did I know at the time that the second and third largest bank failures in our country’s history would be announced that weekend!

In response to the last financial crisis, Congress passed in 2010 the Dodd-Frank Act which put into place too-big-to-fail restrictions on banks with over $50 billion in assets. And this week many people, including Senator Elizabeth Warren, are blaming the current bank failures on 2018 legislation which amended the Dodd-Frank restrictions to only apply to those banks with over $250 billion in assets (Silicon Valley Bank had $212 billion in assets and Signature Bank had $110 billion).

In 2018, when the revisions to Dodd-Frank were being debated, I wrote about a fascinating paper published by the International Monetary Fund, which analyzed the boom and bust cycles worldwide over the last 300 years. The paper clearly points out the demonstrated government regulatory cycles: following financial crises, we significantly increase regulations, and following financial booms we go through significant deregulation which is always followed by another financial crisis. The paper documents history proving that our actions and inactions can create a cycle of financial crises.

Obviously, the primary financial regulator, the Federal Reserve, did not properly monitor what was going on at SVB and Signature, and many blatant warning signs went unnoticed.

We are now entering another financial crisis, and I pray our politicians and government officials will finally learn the lessons proven by the last 300 years of financial booms and busts.

Further reading:

Elizabeth Warren: Silicon Valley Bank Is Gone. We Know Who Is Responsible. https://www.nytimes.com/2023/03/13/opinion/elizabeth-warren-silicon-valley-bank.html (may require a subscription)

Regulatory Cycles: Revisiting the Political Economy of Financial Crises https://www.imf.org/en/Publications/WP/Issues/2018/01/15/Regulatory-Cycles-Revisiting-the-Political-Economy-of-Financial-Crises-45562

Richard Bowen is widely known as the Citigroup whistleblower. As Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, he repeatedly warned Citi executive management and the board about fraudulent behavior within the organization. The company certified poor mortgages as quality mortgages and sold them to Fannie Mae, Freddie Mac and other investors.

Richard Bowen is widely known as the Citigroup whistleblower. As Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, he repeatedly warned Citi executive management and the board about fraudulent behavior within the organization. The company certified poor mortgages as quality mortgages and sold them to Fannie Mae, Freddie Mac and other investors.