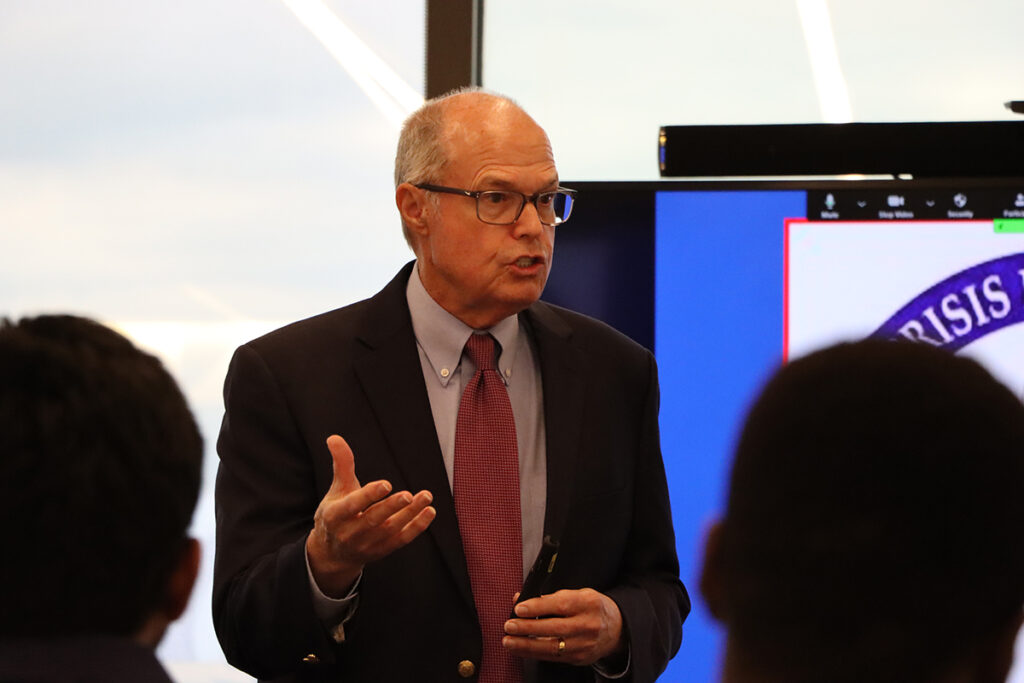

I spoke recently at the new Dallas campus of Texas A&M Commerce University to their graduate and undergraduate business students and alumni, with many others, including some Texas A&M financial planning students, attending virtually via zoom.

Professor Jared Pickens, the organizer of the event, asked me to speak on “Ethics in the Last and Next Financial Crisis,” a favorite subject of mine.

We talked about the breakdowns of ethics I had witnessed when Citigroup sold defective mortgages representing to the purchasers that the mortgages were not defective, with this fraudulent behavior leading to the massive losses in mortgage-backed securities which fueled the resulting financial crisis. And it was noted that these breakdowns also occurred at many of the large banks, as evidenced by many other whistleblowers coming forward.

We specifically discussed my warning Citigroup management for eighteen months about the potential huge losses and, finally, after directly warning Robert Rubin, the newly-elected Chairman of the Board, my being stripped of my responsibilities and told not to come back to the bank.

I also subsequently witnessed breakdowns of government ethics at the Securities and Exchange Commission, the Financial Crisis Inquiry Commission and the Department of Justice, when those agencies attempted to conceal my evidence and testimony from the American public. This resulted in no one holding bankers accountable for their massive fraud.

I shared with the soon-to-graduate students some significant research into how they can tell if a corporation has an “ethical corporate culture” and how they evaluate what to do if they witness unethical behavior at the office.

And we also discussed the Corruption Perception Index “CPI” published annually by Transparency International, which the most widely recognized ranking of public sector (government) corruption in each of the countries of the world. This shows that the U.S. continues to slip and is now tied with Chile and ranking 27th in the world with regard to corruption (25 countries in the world have less government corruption than the U.S. and Chile). Unfortunately, these statistics do not bode well for future effective government regulation and reinforces the possibility of still another, even more costly, financial crisis.

However, in the follow-on Q&A session the students recognized the need for ethical behavior and decision making and the absolute importance of the students being true to themselves in their careers. This recognition, truly, is the only way our country can reverse the ethical decline of our country.

Richard Bowen is widely known as the Citigroup whistleblower. As Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, he repeatedly warned Citi executive management and the board about fraudulent behavior within the organization. The company certified poor mortgages as quality mortgages and sold them to Fannie Mae, Freddie Mac and other investors.

Richard Bowen is widely known as the Citigroup whistleblower. As Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, he repeatedly warned Citi executive management and the board about fraudulent behavior within the organization. The company certified poor mortgages as quality mortgages and sold them to Fannie Mae, Freddie Mac and other investors.