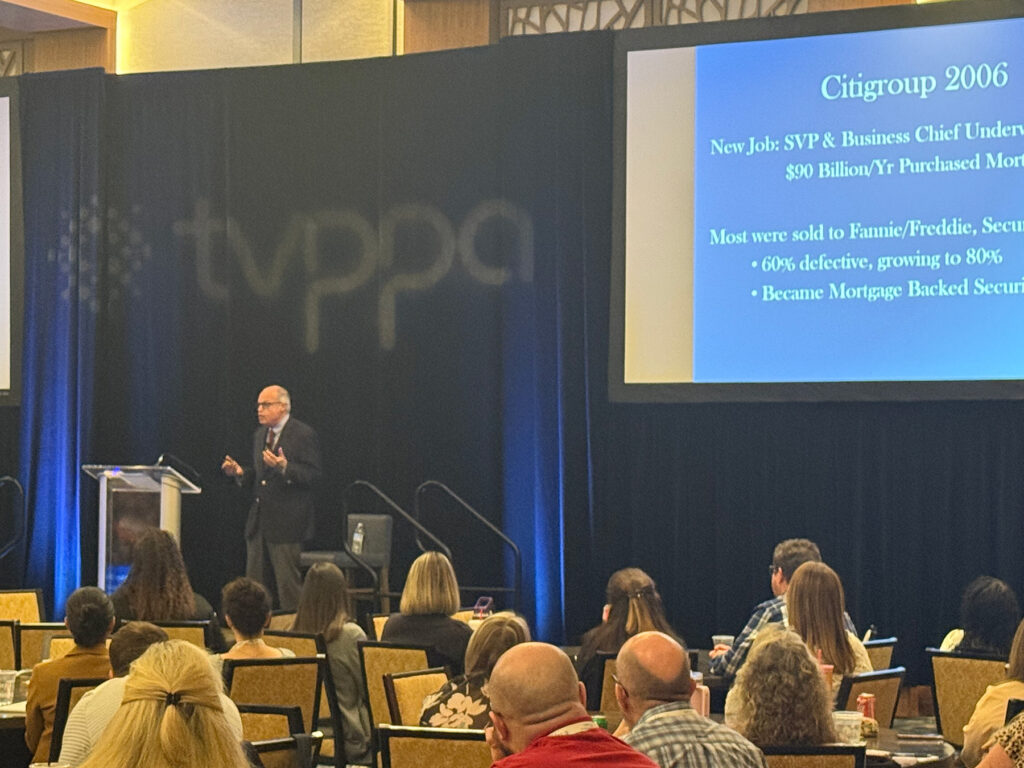

The Tennessee Valley Public Power Association (TVPPA) gave me the honor of delivering their 2025 conference keynote address. This especially humbled me when I learned that conference attendees choose their next keynote speaker and the 2024 attendees chose me, the Citigroup Whistleblower, for their 2025 conference.

The TVPPa sponsors this annual three-day conference for key accounting and finance employees of 153 affiliated local power providers across the seven-state Tennessee Valley region. This year, we went to Chattanooga, Tennessee.

During the keynote, I talked about the breakdowns of ethics I had witnessed when Citigroup sold defective mortgages, representing to the purchasers that the mortgages were not defective, with this fraudulent behavior leading to the massive losses in mortgage-backed securities which fueled the resulting financial crisis. And I noted that these breakdowns also occurred at many of the large banks, as evidenced by many other whistleblowers coming forward.

We specifically discussed my repeatedly warning Citigroup management for eighteen months about the huge potential losses and, finally, after directly warning Robert Rubin, the newly elected Chairman of the Board, the Chief Risk Officer, Chief Financial Officer and Chief Auditor, I was stripped of my responsibilities and told not to come back to the bank.

I can hope that, since an industry conference invited me to speak, the public power industry in that area is looking for ways to ensure their employees feel comfortable acting ethically and reporting unethical behavior. Based on some of the discussion, I believe attendees took away the importance of acting ethically at every level.

I also told the auditors that I witnessed breakdowns of government ethics at the Securities and Exchange Commission, the Financial Crisis Inquiry Commission, and the Department of Justice, when those agencies attempted to conceal my evidence and testimony from the American public. This obviously resulted in no bank executives from Citigroup or other large banks being criminally prosecuted for the massive frauds that were committed.

As often happens, the realization that bad actors not only didn’t see justice, but that those tasked with serving justice covered it up, surprised some of the attendees. As it should. We entrust people to act ethically and in the best interest of a larger group; we are naturally taken aback with they instead act on behalf of their own selfish aims. But that’s why I talk about my experience: So people know what can happen, and so people know what they might expect when they speak out in their own situations.

In the survey taken after my talk, it was obvious that the audience got my message, with one response stating, ”He was a very interesting speaker and just so sad that nothing happened to the people that allowed this fraud. He tried so hard to bring this to light and was buried at every turn. It is hard to hear that our own government would cover up such a mess.”

Richard Bowen is widely known as the Citigroup whistleblower. As Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, he repeatedly warned Citi executive management and the board about fraudulent behavior within the organization. The company certified poor mortgages as quality mortgages and sold them to Fannie Mae, Freddie Mac and other investors.

Richard Bowen is widely known as the Citigroup whistleblower. As Business Chief Underwriter for Citigroup during the housing bubble financial crisis meltdown, he repeatedly warned Citi executive management and the board about fraudulent behavior within the organization. The company certified poor mortgages as quality mortgages and sold them to Fannie Mae, Freddie Mac and other investors.